Hi, I really hope someone can help me here. It seems every day now I am losing 3-4 sICX through rebalancing. My sICX balance is significantly less than it was when I first provided collateral in Balanced. I thought the sICX balance was supposed to increase over time? I did take out a small loan which I used to buy and stake more BALN. That bit is working quite well. The All time bnUSD Balance is -384. Does this mean that’s how much of the loan has been paid back? Sorry, I still find rebalancing very confusing. I can only assume that some of my loan has been paid back by rebalancing, but I am starting to panic as to why my ICX is significantly less than when I first provided collateral. What is going on here? I would really appreciate some help. I can provide screenshots etc if necessary. Thank you!

I believe so.

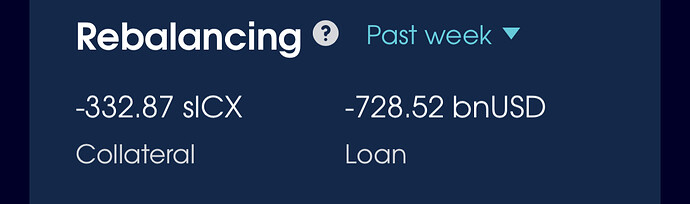

In this screenshot -332.87 sICX collateral and -728.52 bnUSD.

That means 332.87 sICX has been sold from collateral (reducing sICX collateral), for 728.52 bnUSD (reducing borrowed bnUSD). This has happened at an average price of 2.188 bnUSD per sICX.

Do you remember what your risk level was? In my expirience you would now be able to get more bnUSD as your loan has decreased. Now, what you do with it is your decision but I have a certain treshhold that I am re-borrowing. And even though I am in the same situation as you - my overall balance is going up.

Thanks! I’ve been on the Balanced Discord and they explained it well. I had no idea the loan would be paid back by rebalancing. Just exactly as you have explained. Thanks for the help. I can stop panicking now

My risk level is also very low. I’m terrified of being liquidated so I try and keep it around 45c max. If the price gets anywhere close to it then I will buy more ICX and add it as collateral. This should lift my liquidation price.

FYI after I finally understood what was going on, I took out another small loan. I’m using it to increase my BALN holdings further. Thanks for the reply.

Thanks. Funnily enough, I changed from sICX/BALN to bnUSD/BALN. The APY looks higher. I would imagine the Rebalancing will be fairly similar.

Rebalancing is the same. It doesn’t matter what LP you are in - it’s all based off your loan amount.

The bnUSD has a higher APY even after the recent increase of sICX/BALN pool but it has a higher chance of impermanent loss so I suggest you research what this means if you don’t already know.