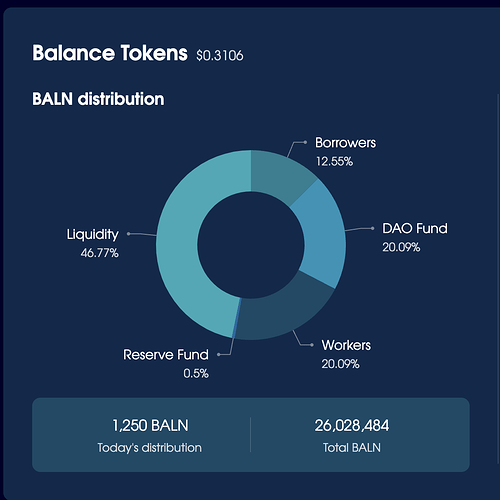

It has been a while since we revisited the allocations of BALN emissions and they could use some changes to better align with our current situation. See a screenshot below of the current allocations

Reserve - This is an outdated mechanism to handle bad debt, and something we should never rely upon anyway. There are much better ways to handle small amounts of bad debt.

Liquidity - This is rewards for liquidity providers, one of the more important allocations

DAO Fund - This is issued directly to the DAO Fund and retained

Workers - This goes to the holders of BALW, the initial incentive for the team building Balanced in the early days. This is also essentially obsolete, as most of the funding for development comes from the DAO Fund. It’s a better and more clear structure to fund development

Borrowers - This is a reward based on the amount of bnUSD you have borrowed relative to others. With the savings rate well above the cost of borrowing, this is a redundant reward at this stage and could be better utilized elsewhere.

Proposal

With all that in mind, I propose a simpler structure focused on liquidity and building up the DAO Fund reserves to be used for ad-hoc incentives going forward.

Reserve - 0%

Workers - 0%

Borrowers - 0%

Liquidity - 60%

DAO Fund - 30%

Savings rate - 10%

Note, incentivizing the savings rate with BALN will take some development effort. I wanted to show the above proposal as our mid-term goal, but in the short-term, prior to development of the savings rate incentive bucket, I’ll propose the following:

Reserve - 0%

Workers - 0%

Borrowers - 0%

Liquidity - 60%

DAO Fund - 40%

Savings rate - 0%

Open to feedback, will look to put this up for vote in the next 1-2 weeks.