Also, when Parrott mentioned the extra 45k would be the last website upgrade Balanced would “ever” need concerns me? Technology is constantly changing, seems like a unique thing to say, sorry for all the posts, I will limit them from here on this subject as I don’t want to be overbearing with the amount of posts I made. Just great discussion, I greatly appreciate Balanced, the workers, ICX community.

After live voting has been implemented, the only noteworthy changes in the pipeline are to support arbitrary contract calls for governance proposals, and updates to the Stats page. Arbitrary contract calls will be addressed because bBALN holders won’t be able to submit proposals through the UI without it, and work on the Stats page is covered in this proposal.

However, unless we reposition this proposal to cover all our work on Balanced for a specific time period, no other updates to the app will be included, only bug fixes, until we secure more funding to work on BTP features.

The problem with splitting the proposal up into 2 parts is that some community members don’t agree a website upgrade is required at all. If we split it into two parts, some information will be up to date and the rest won’t be, and we’ll be reliant on the community to approve the second round, which I’m sure many would be less inclined to do.

We also tend to work laterally rather than on a single page at a time. You could argue that the landing page is a standalone update, but it will include sections that link off to the How page and Stablecoin page, in particular, which would lack the content updates necessary for a coherent funnel between pages. In order to make it work well, we would already need to do most of the content work in the background.

All IUSDC and USDS is converted into BALN before being added to Balanced’s holdings, so the amount specified in the proposal has been stable since 19 Nov 2021. bnUSD is also our preference, but we wanted to simplify Balanced’s holdings, so the plan is to take all the IUSDC and USDS, use the Stability Fund to convert it to bnUSD, then hold it in Omm until it’s time to spend it.

Someone in Discord also suggested to take all the other small balance assets (OMM, IUSDT, CFT, METX), and convert them to BALN to increase buying pressure. As it only amounts to an extra ~$780, we’ll likely also propose this and lock it up for at least 6 months.

Fair questions. Considering how recklessly many DAOs spend their funds, we appreciate your prudence. Blockchain is all about transparency, so we’re happy to lay out the numbers for you.

ICON has been our sole focus, for which we have 3 sources of income: validator rewards, BALN worker rewards, and OMM worker rewards.

These rewards are expected to cover all user-facing work for Balanced and Omm, including product design, QA, website updates, documentation, marketing, and hosting costs, as well as frontend development on Balanced. Our work in the ecosystem is interconnected, so we also do peripheral work to solve problems we’ve identified, like an onboarding funnel (whyicx.com) to help more people get started with ICON and our products. We are not paid extra to do this.

We’re one of 6 teams Balanced delegates ICX to, and one of the 4 defaults on Omm, which gives us just over 14M total votes.

Everything we’ve earned in the ICON ecosystem over the last 3 years has been invested into our bond, which has since dropped 80% in $ value and allows us to earn 60% of our potential rewards. For that position, we earn 340 ICX per day, currently worth 58 USD or $21,170 per year. Our node on AWS cost $793 last month, so deduct $9,516 for a net return of $11,654.

As discussed earlier, our share of Balanced worker tokens pays out $43 a day at current prices. The amount of BALN received drops daily, but assuming a steady rate and price, that’s $15,695 per year.

We hold 15% of the Omm worker tokens, which pay out 13,500 OMM per day (currently worth $136). Ignoring the inflation decrease in August, at current rates we could expect to receive $49,640 over the next year.

11,654 + 15,695 + 49,640 = $76,989 per year

We’re currently attempting to split that between 4 people and a business, meanwhile every single one of us could walk into a Web2 job with a $120k+ starting rate.

We love working in the ICON ecosystem, but our position is not sustainable.

Much appreciated. ![]()

The design will be updated, but it’s not so much about the look as it is about the content. As we like to say: content is Batman, everything else is Robin.

When we launched Balanced, the main focus was how you could use it to earn rewards. That’s ultimately all anyone wanted to do, so why beat around the bush? Many features we have now didn’t exist then, and the Balanced Dollar stablecoin model was still experimental. Even balanced.network/stablecoin, which was released earlier this year, has to be changed because the Stability Fund is now the primary stability mechanism for bnUSD.

Most of the details have been adjusted many times, but the changes are now substantial enough to rethink the entire page structure, and make sure it’s flexible enough to support future changes.

After the landing page hero (the intro content on a marketing site), the page will be split into 3 sections to provide more details about Balanced’s core offering:

- Loans / The Balanced Dollar stablecoin

- Trading / The decentralised exchange

- Governance / The DAO

Balanced’s multi-chain aspirations will be weaved throughout.

We had also planned to feature the DAO Fund, feature projects Balanced has funded (i.e. Foligator), encourage teams to build on top of Balanced, and begin formalising the process for funding requests and progress updates, but that’s dependent on the community’s appetite for spending in general.

As for the Stats page, this repository lists most of the updates and enhancements we’d like to tackle.

A better question might be, “How can we support PARROT9 to continue working in Balanced’s best interests?” The website and the Stats page are the deliverables, and in our professional opinion are much-needed, but ultimately the grant will help our team survive until we can secure cross-chain funding to take Balanced to the next stage.

For the record, we didn’t sell. Witnessing all the meme coins and rug pulls while building Balanced, we were determined to approach it differently. We gave some of our BALN away, but we were always focused on accumulating for the long-term so we didn’t want to dump our tokens and take advantage of the people willing to buy it at ludicrous prices.

I recently had to provide our accountant with details for every transaction, so I went back to check: the first time we sold BALN from any of our wallets was May 27 2022 — 13 months after Balanced launched.

Appreciate your thoughtful responses and respect and not just brushing them off.

It seems like we are in the perfect “prisoners dilemma” where Stakers have obviously been hammered on both OMM and Balanced. But anyone that has held any crypto has been hammered, maybe not at our level, but I’m here long term and can have a good attitude about it.

Your team can’t even utilize the ICX delegation rewards from BALN Stakers that automatically get distributed to you because you don’t have enough ICX to capture the value, with times so tough I can sympathize that buying ICX may not be feasible for your team.

You are hurt by this, as well as the Stakers who have been getting 2% rewards on an asset that’s down 95 plus percent, when we could have been receiving ICX or other rewards delegating to PREPS of our choice. So the pain would have been offset a little.

Any possibility for CPS funding? I appreciate your work in all areas of ICON, nothing is easy building. As an investor I appreciate your honesty!

I hold a decent amount of BBALN and I really appreciate your responses.

Yeah, that’s fair. I would approve all four pages, but just wanted to bring up the idea of splitting it. Thanks for the clarification on using the stability fund to convert to bnUSD.

With that said, I wish you didn’t mention depositing the bnUSD into Omm until it’s time to spend it because that does make me feel a little uneasy. Why not just convert the bnUSD to fiat to lock in that funding? Otherwise, you would be opening yourself up to two kinds of risk – bnUSD peg risk, Omm smart contract risk. The risk for 3-5% APY for a few months doesn’t seem worth it, and some may question whether you really need the money if you’re willing to be so risky with it. I get that it’s important to support ICON DeFi platforms, but I don’t think this should be done with grant money. Just my opinion though, I know that post-distribution, it is your money and you should be able to do whatever with it.

You are hurt by this, as well as the Stakers who have been getting 2% rewards on an asset that’s down 95 plus percent, when we could have been receiving ICX or other rewards delegating to PREPS of our choice. So the pain would have been offset a little.

We’ve always been supportive of opening up the ICX delegation to bBALN holders. It’s fairly straightforward from a UI perspective, but it does require a smart contract dev and those contributors have been focused on live voting and cross-chain efforts. However, if you’re able to get a smart contract dev onboard and the community wants to fund it, we’ll find a way to include it in the app.

Any possibility for CPS funding? I appreciate your work in all areas of ICON, nothing is easy building. As an investor I appreciate your honesty!

We do have a new project proposal lined up for the CPS that we’ll submit during this funding cycle or next, so that should hopefully alleviate things also.

Appreciate your support! ![]()

Thanks for sharing your perspective on this, it’s not something we’d considered. We’d sell out at least half to fiat immediately, but we pay one of our contributors in crypto so planned to leave the rest in bnUSD until needed.

We felt it best to put the bnUSD into Omm to stretch out the value as much as possible, but you’re right that it won’t make any appreciable difference in just a few months, so we’re just as happy to hold it. The bnUSD peg risk seems like less of a concern, though, given that we can always trade 1:1 with the Stability Fund?

Yes, I remember months back you were the only “workers” who was supportive of Balanced holders being able to vote for PREPS of their choice.

I’m not saying that i think it is best to take delegation away from workers when they need it most.

Now that BALN workers tokens are diminishing due to inflation limiting it seems like our workers “best future compensation” will be from our automatic ICX delegation, but need to make sure our workers can actually utilize our automatic delegation.

The sad fact of the matter is….

Right now you’re team is missing out on 18k a year because you can’t bond accordingly, but your team is instrumental to ICON.

These are good discussions, I wish I had the right answers.

I propose that Balance use their DAO funds to ramp up a PREP node. ICON is all about getting more quality PREPS

Then all of our ICX Delegations will go to this node. From there the BALN lead worker can split they rewards to the workers making things happen on Balanced.

Right now we don’t know if other workers have the same issue securing enough ICX to cover a bond. This will also give more transparency to our DAO.

This isn’t ideal for the ICON Network as it centralizes stake on one node.

You can get a rough idea here, along with stats.balanced.network to figure out total sICX holdings. Mousebelt, Sudoblock, Lydia Labs, Parrot9, ICONosphere and ICONDAO all contribute, so u can divide ~25M ICX by 6. Comes out to ~4.15M ICX delegation per team.

So from there, look at the RHIZOME tracker I looked for a team with ~4.15M power. I found Metanyx, which earns ~850 per month worth of ICX. So each team is getting an extra ~850 per month for working on Balanced. Objectively, that does not cover costs. It roughly covers the cost of the node.

Yes, having one Balanced node would be more transparent, but also not so great for the ICON Network. As for securing a bond, you can see all that on the RHIZOME tracker also.

Have just submitted a proposal for this, so voting starts tomorrow.

Times like this I would like to have some more Bbaln…

For whatever it’s worth… just voted Aye!

Appreciate your support! ![]()

I voted yes on the proposal, I hope you get the funding you need.

I hope we can talk about this more as a community. If it takes DAO funds to fund your team and also incentivize a smart contract developer to get this feature added, then I think that would be money well spent. Not only does it add value to bBALN, but it also benefits Icon by decentralizing votes.

The biggest arguement I have seen against it is that those votes provide much needed funding for teams working on Balanced. I am all for funding the teams, but I believe it should be done through official channels such as proposals like this. Also, as has already been mentioned in this thread, a lot of that voting value is lost due to not being able to maintain an appropriate bond.

It’s now been 3 months since this proposal passed, so it’s time for an update.

Progress has been a bit slower than expected due to some hurdles outside of our control, including the Omm exploit. However, work is going well, and we can provide more regular updates as we move into the second half of the project. We appreciate the patience you’ve afforded us thus far.

Here’s where things currently stand.

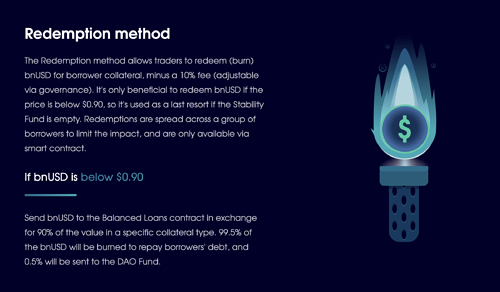

Stablecoin page (review phase)

The content and design for this page are complete. All that’s left is a final review and polish, and the addition of some APIs to ensure the numbers we’ve included are always up to date. However, we’ll wait until the landing page and How page are also complete before we push the update live.

Main highlights:

- Replaced the rebalancing content with information about the Stability Fund and redemptions

- Added a section to show the total bnUSD supply and the value backing it

- Repositioned the page to focus on bnUSD instead of loans specifically

- Optimised the page to improve performance and eliminate outstanding bugs

Here are some previews:

The recent switch from rebalancing to redemptions was a big deal, so we also leveraged some of this work to promote it. Here are a few of the design variations:

How page (design phase)

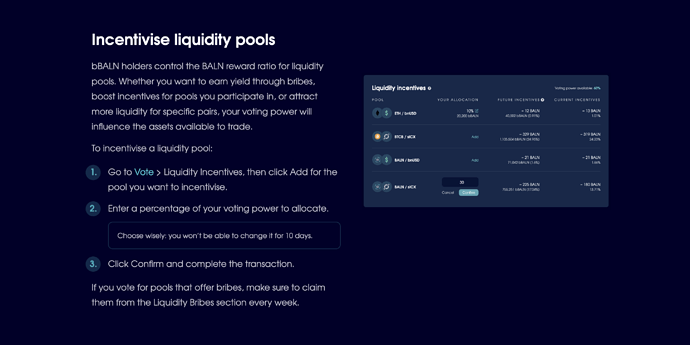

The How page content is in review, and the design work is in progress. We’ve also been making adjustments to the Balanced docs to keep the content in sync.

This update includes new content to support:

- Multiple collateral types

- Boosted BALN

- Live voting

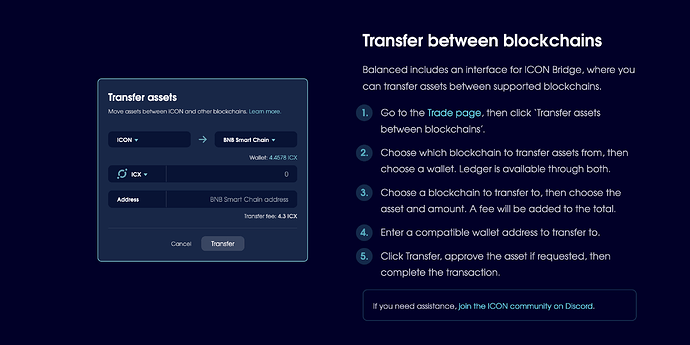

- Cross-chain transfers

The How page has always been instructional, but the additional content can make it look daunting, so a large part of the design work will be focused on page layout.

While still rough, here are some layout variations we’re exploring for the new Borrow Balanced Dollars section:

And here’s the style we’re developing for the iconography:

Landing page (content phase)

We’ve been making good progress on the landing (Home) page, with a full draft now complete. However, it is taking some time to nail down the new messaging, which we want to be less ICON-focused than it has been in the past. It’s crucial to get this page right, as it receives 50x more traffic than the internal pages, and it will be the last page we finalise.

This page will include a section that highlights the DAO Fund, and encourages people to apply for funding to support or build on top of Balanced. To simplify the experience for those involved, we plan to establish some guidelines and create some initial RFPs, which will be housed on the forum for the most transparency.

If any community members have strong thoughts about how the funding and reporting process should work (or if we should emphasise it at all, given the recent focus on protocol-owned liquidity), we’d love to hear from you.

Stats page (in progress)

Unlike the website upgrade, updates for the Stats page are shipped as they’re completed.

So far, we’ve:

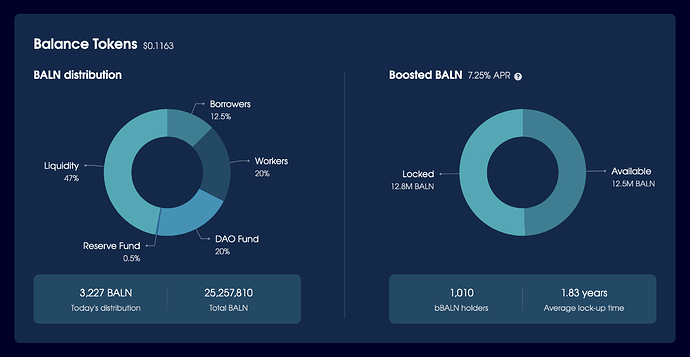

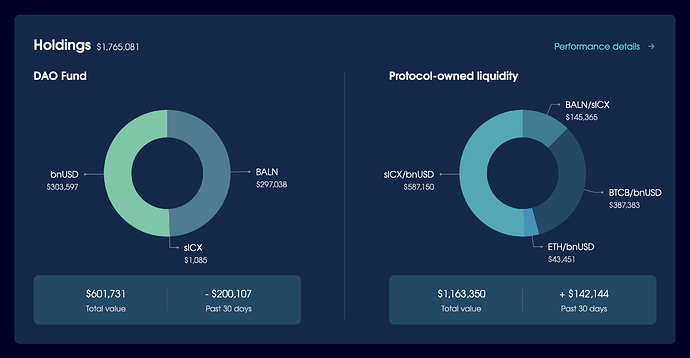

- Added POL and bBALN info to stats.balanced.network/performance-details

- Refactored fee calculations used for stats.balanced.network/performance-details

- Created a historical data getter to support new charts without needing a back end

In progress:

- Update the Stats page and app to use the latest back end infrastructure (should fix residual issues with 24 hour trading volume and fees, will allow all tokens and pools to be displayed on the Stats page, and will assign a price to all tokens)

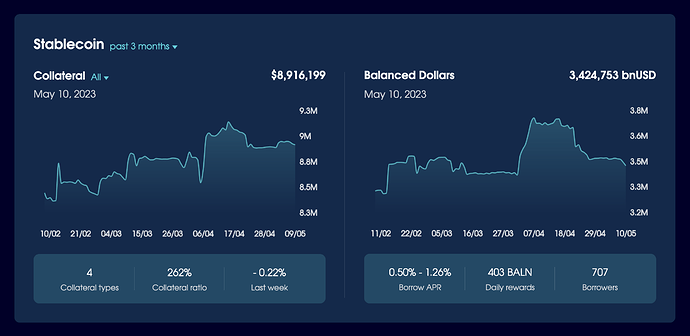

- Update the Collateral and Balanced Dollar charts to show the total value backing bnUSD (almost ready – view the pull request or preview the changes from this development link)

- Update the design to include more details about governance

Planned:

- Add historical charts for tokens and liquidity pools

If there are any data points you’d like us to display on the Stats page, let us know!

App

Although this proposal didn’t cover any work on the app, we also took some time to:

- Update test.balanced.network to use the Lisbon testnet

- Launch and make enhancements to the live voting UI

- Improve the UX for the ICX-only pool

- Improve the unstaking experience

- Fix some outstanding bugs

- Refactor several parts of the code

- Design a UI for people to repay their loan using locked collateral

- Update the Position Details section to reflect the switch from rebalancing to redemptions

The Balanced website and Stats page upgrade is now complete.

Take a look:

balanced.network

stats.balanced.network

Read on for a brief overview of the work involved, and explore our design thinking in this Twitter thread.

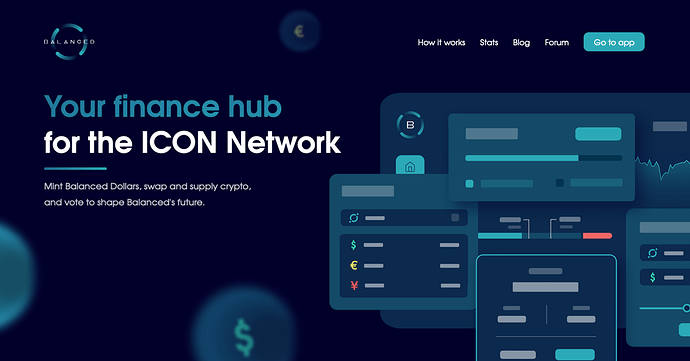

Landing page

The landing page received a complete overhaul to emphasise the stablecoin and exchange (Balanced’s core offering).

The aim was to make the page as readable and modular as possible, so we grouped the content into sections that cover each of the main themes:

It surfaces many important figures, like the total supply and backing of bnUSD, and the amount of liquidity & volume on the exchange.

Social proof increases credibility and conversions, so we also added a section (and Reviews page) with praise Balanced has received since launch.

Cross-chain is only a minor focus of this page, but we’ll add a section dedicated to it while we work on the cross-chain UX in the coming months.

How-to

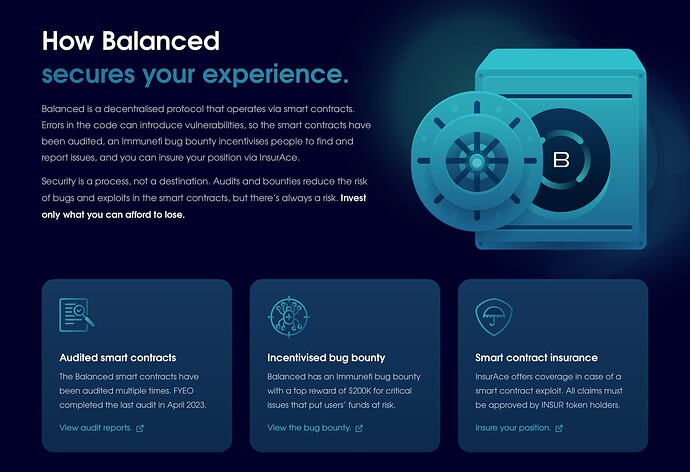

All content on the How-to page has been refined, and all images replaced.

It now includes a range of animated icons and illustrations, and information to support:

- Multiple collateral types

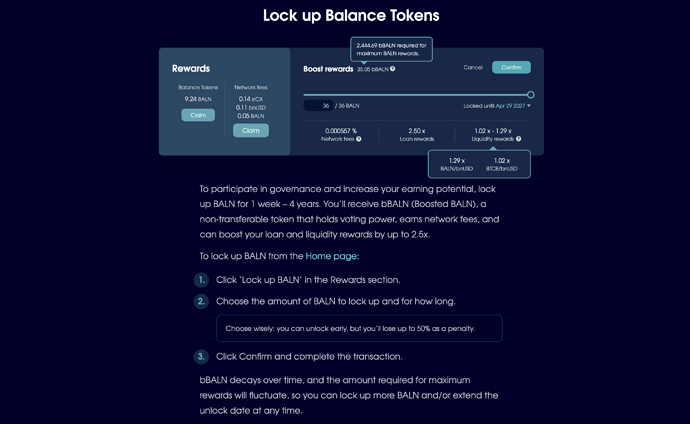

- Boosted BALN

- Liquidity incentives & bribes

- Cross-chain transfers

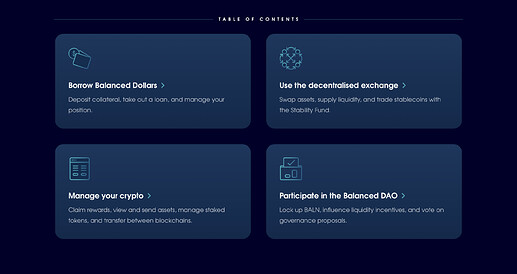

Like the landing page, we organised the How-to content based on the core tasks you can complete in the app: borrow bnUSD, use the exchange, manage your crypto, and participate in governance.

It’s a long page, so the table of contents helps people navigate to the information they need…

…And the illustrations help to break up the content.

Stablecoin

The Stablecoin page needed only minor adjustments, most of which were mentioned in our last forum post:

- Replaced the rebalancing section with information about the Stability Fund and redemption mechanism

- Added a section to show the total bnUSD supply and the value backing it

- Repositioned the page to focus on bnUSD instead of loans specifically

- Updated the content to reflect bnUSD’s multi-collateral reality

- Introduced a cross-chain focus

- Updated the hero image, and added a new redemption animation

- Optimised the page to improve performance and eliminate outstanding bugs

Brand

As part of this update, we also enhanced the design style for icons, illustrations, and various page elements.

We liked the new panel style so much that we plan to evolve the app UI to match.

The Balanced NFTs are integrated into the design of each page, and we added an NFT page to make the Balanced collection easier to browse.

We’re still updating the Brand page to accomodate for all the changes, but we’ll have it ready to share with you soon. It will include some new marketing assets for the branding pack, which anyone can use to promote Balanced in a way that’s true to the brand

Stats page

The Stats page has received a number of updates. Most of the recent changes were covered in this tweet thread, but in brief, we:

- Updated the Collateral chart to support multiple collateral types (including the amount of bnUSD minted against each), and combined it with the Balanced Dollar chart to create a new Stablecoin section

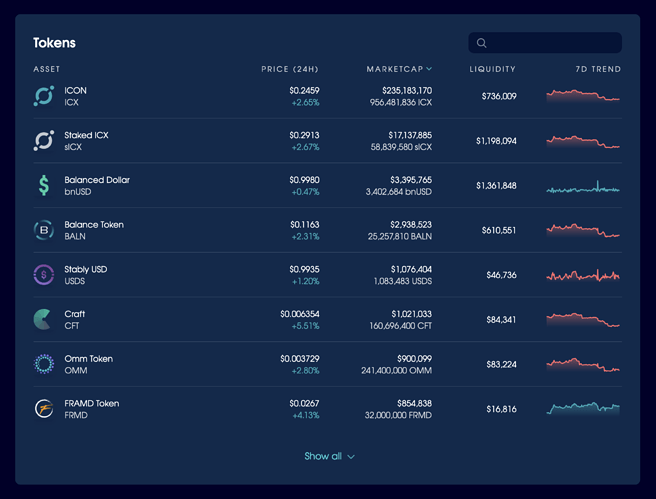

- Added spark lines to the Tokens section

- Changed the token price sorting to order by change over the last 24 hours

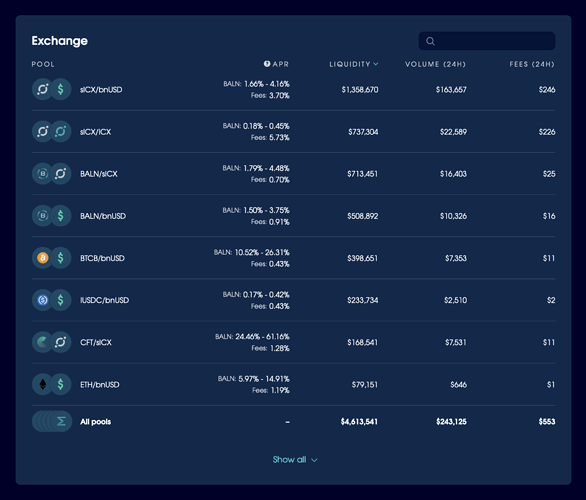

- Limited the Tokens and Exchange sections to 8 listings, with the ability to view all and filter the list (and if you filter the Exchange section, the total liquidity, volume, and fees will update to reflect the search results)

- Added 3 governance sections to display information related to proposals, BALN/Boosted BALN, and the DAO Fund

- Added protocol-owned liquidity info to the Performance Details page

- Updated the back-end APIs

In closing

Our goal was to make the old website obsolete, and we succeeded. We’re more confident than ever in Balanced’s ability to stand out in a cross-chain environment.

While this project has ended, our work on Balanced is not over. There’s still so much we can do to enhance the app, including preparations to take it cross-chain, so we’ve started a new proposal discussion to keep the momentum going.

Hi,

Could you include in your development a connection with one of the leading crypto tax software companies? If we want to really grow we need to spend a lot more time making past transactions more accessible other leading DEFI projects. A community member in this forum asked for this in April and no one was able to answer his question, because we are not connected to leading tax software.

Also, is there any word on the ICON cross chain grants? It would be useful to utilize these grants for cross chain development:)

Thanks for all your work:)